B2B analytics platform for tire prices and stock levels

A B2B pricing and inventory portal for the tire market — part of Michelin’s project to streamline procurement and supply coordination for wholesale partners.

Background

In the middle of the summer of 2021, over 64 million cars were driving on Russian roads. And each of them changed tires from summer to winter and vice versa twice a year. Changing tires is a traditional annual ritual of a motorist, and buying tires is an inevitability. It's all a matter of driving conditions: someone will buy new tires after three years, and someone will renew them after six.

There are enough tires in Russia: 18 Russian factories alone produced over 65 million tires in 2021, and the total capacity of the Russian tire market exceeded 70 million units.

But it is not enough to produce tires, they must also be delivered to all corners of Russia, and then sold to fans of iron horses through various channels.

In 2021, our long-standing client and one of the leading tire manufacturers in Russia, Michelin, approached us with a specific request.

The problem was that before a tire ends up on the rim of a car, it takes a bizarre journey from factory to store through large dealers with their offices in different regions of Russia, as well as masses of smaller wholesalers. Each large dealer controls by no means the whole territory of Russia, but each dealer has its own warehouses with certain stocks of tires of different nomenclature. Michelin - as a tire manufacturer - wanted not only to increase tire sales, but also to reduce costs - both transportation and time - for tire delivery between participants of the Russian car market.

This is how the idea to create a B2B aggregator of prices and balances of the tire market - a tire marketplace in Russia, bringing together all the bases of major dealers in the Russian tire market, so that both manufacturers and dealers would have a clear understanding of who, where and what tires are in stock.

Approach to implementation

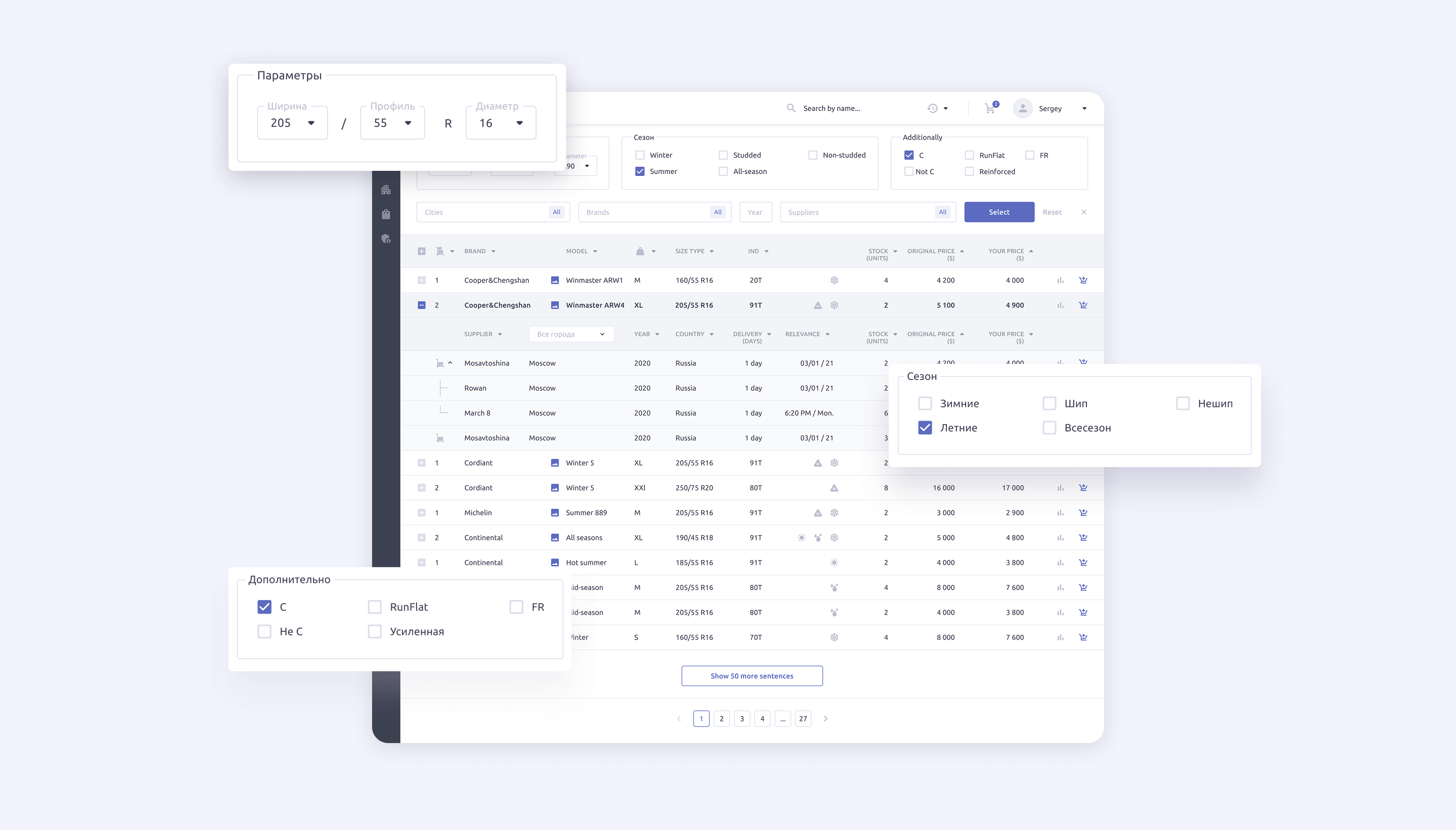

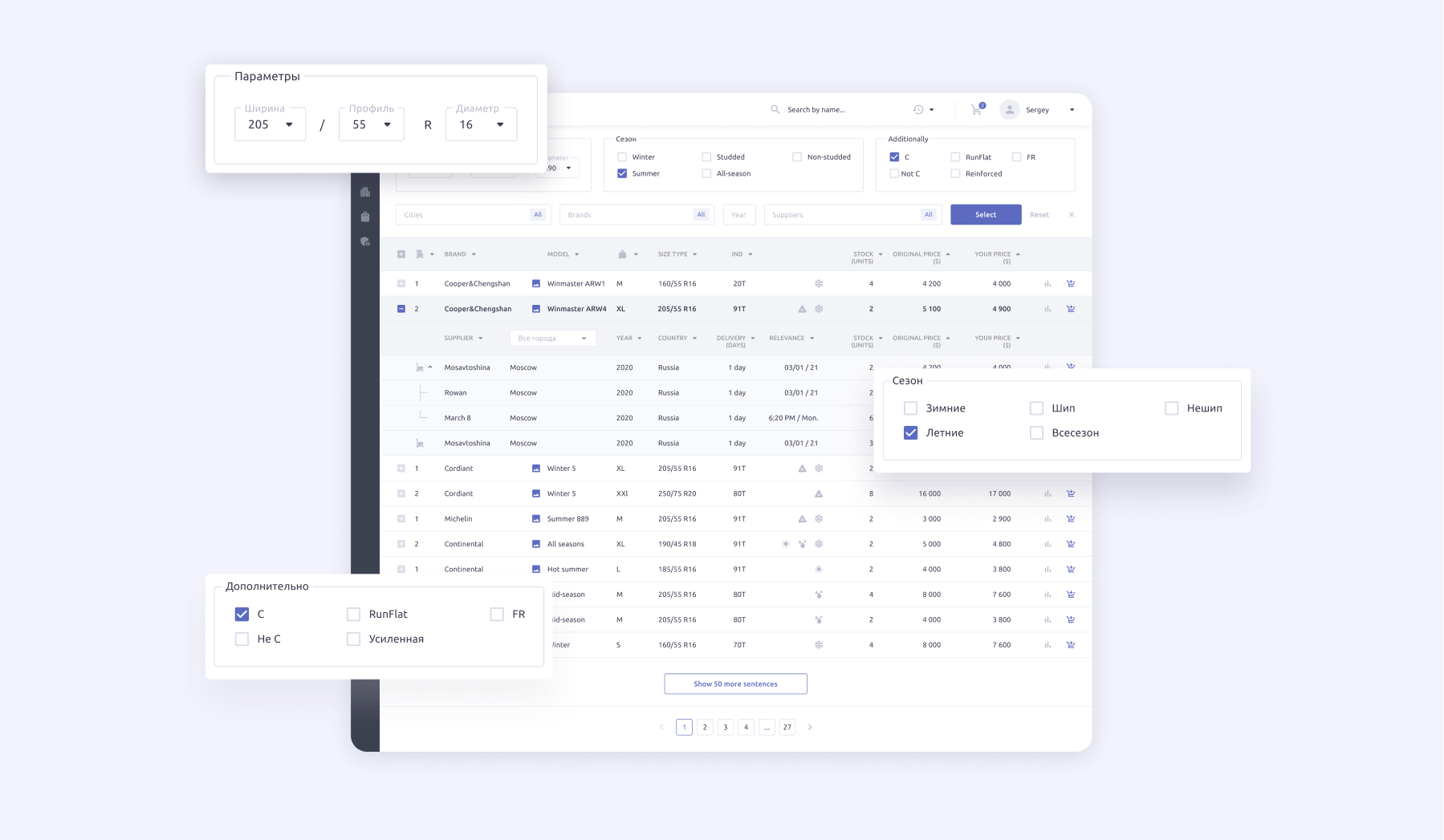

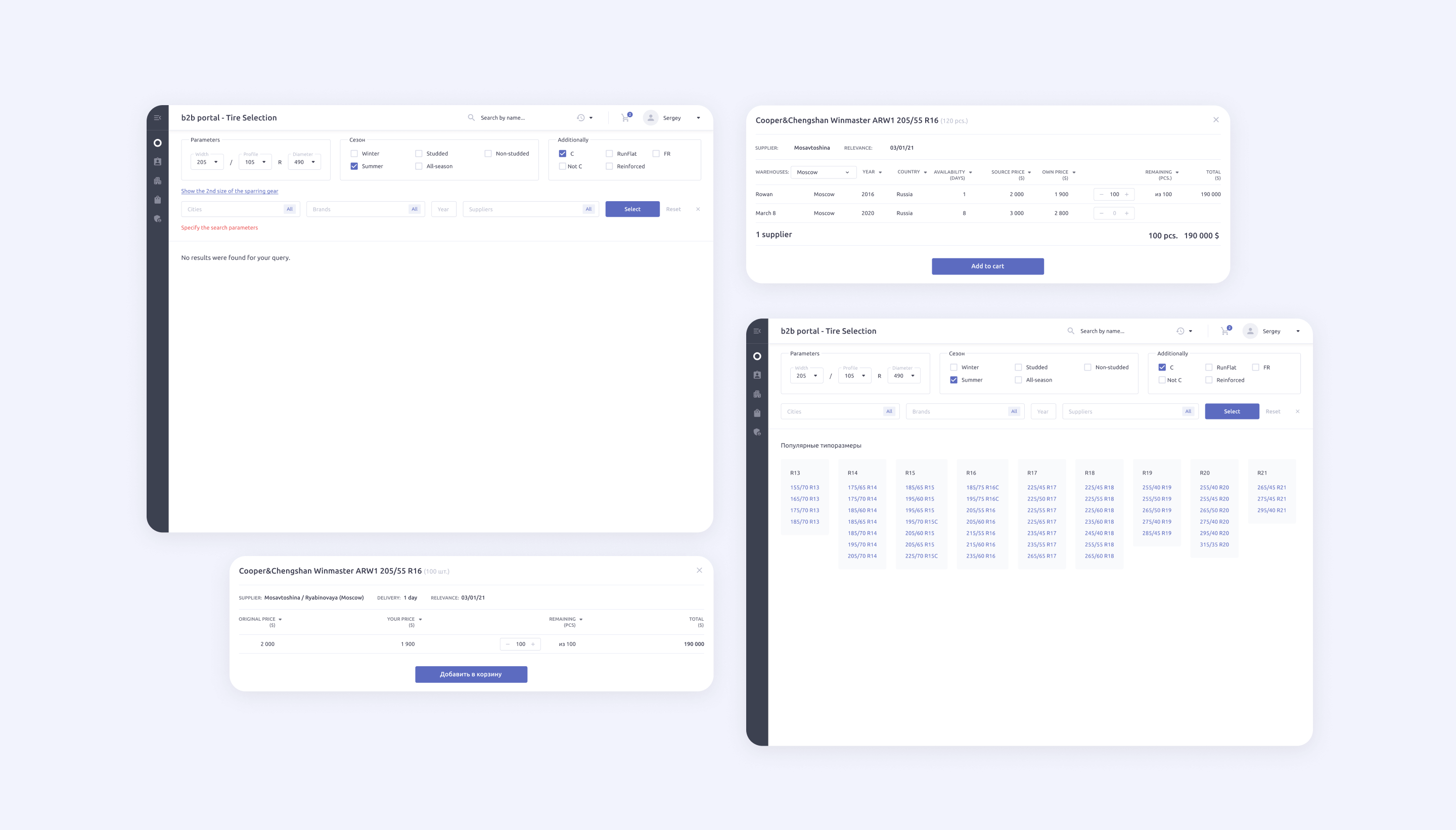

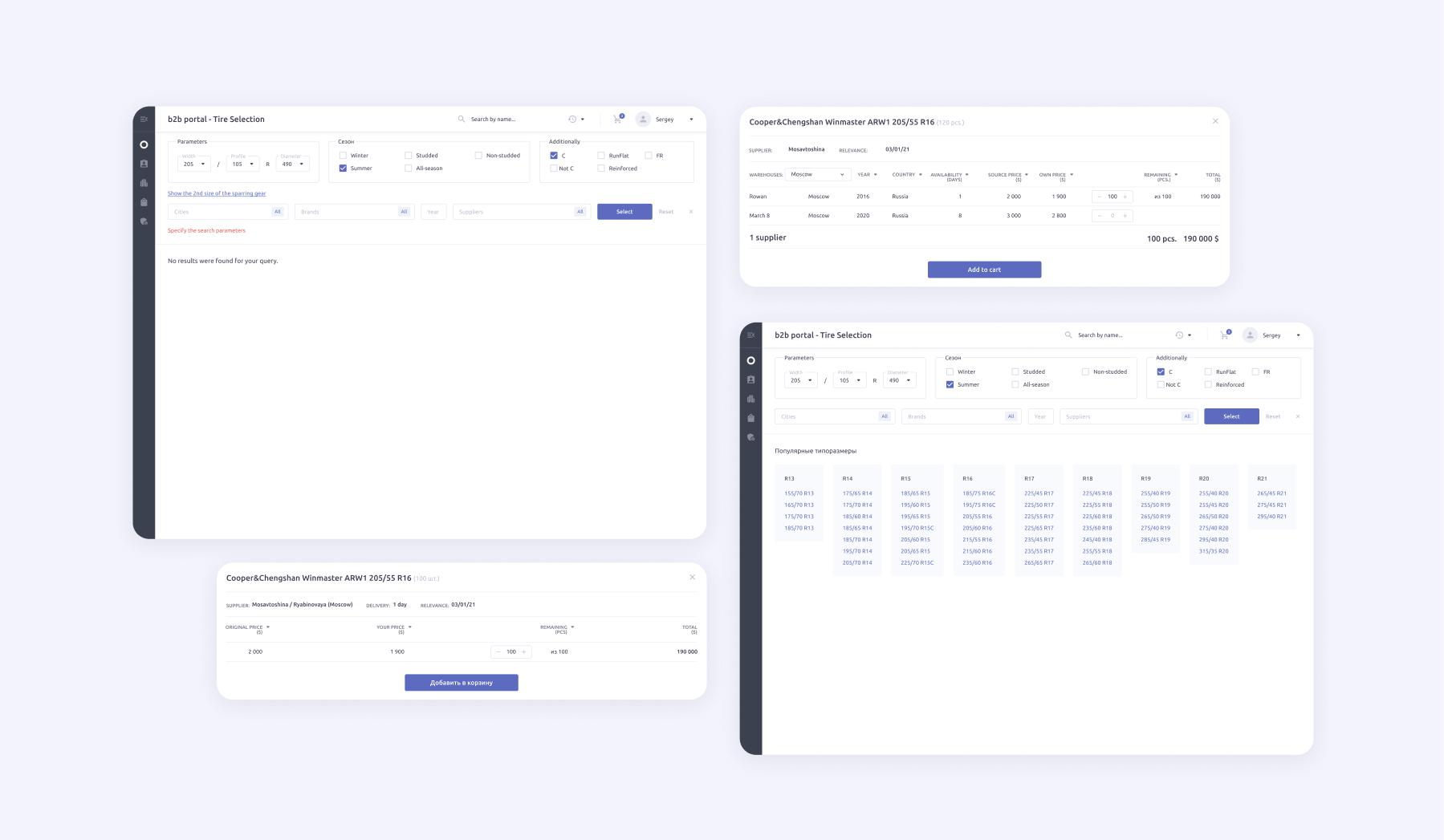

As a result, a system was developed that examined the databases of wholesale and local suppliers once an hour and updated tire balances in warehouses. A tire buyer - a wholesaler of a smaller caliber - could select tires of interest through the system and add them to a virtual cart. And further orders were automatically placed on the sites of large wholesale suppliers. So for one order a wholesale buyer could buy tires from several wholesalers at once.

At the same time, despite the general classification of tires by width, profile height and fitment size, tires differ in a number of other parameters, and tire markings of large dealers are different. The question arose: how to bring tire stocks at wholesalers to a common denominator so as to reduce to a minimum, or even better, to avoid errors in ordering, so as not to lose time, money and customer loyalty.

We realized that we had to turn our aggregator into an expert in the Russian tire market. At first we taught it manually: during the first orders, a person trained the system by checking the correctness of tire parameters from different suppliers. Later on the system, having established regularities and peculiarities of both tires and their features in the master data of different suppliers, began to automatically mark discrepancies and unify the data. This allowed the system users to get the tires they needed - when ordering tires from the aggregator in the systems of the end dealer in the cart were exactly by the article clear for the supplier.

The more synchronizations with wholesalers' databases our system performed, the smarter it became and the less the probability of technical error when ordering tires became, and therefore the risks of dissatisfied users of our system decreased.

Analytical unit

For the wholesaler, this system allowed him to keep his finger on the pulse of the tire market and more accurately anticipate the future demands of his customers, reducing delays between ordering and shipment of tires. And also - thanks to the continuous analysis of tire balances in the warehouses of all wholesalers - the system timely signaled to dealer managers about the need for timely replenishment of stocks based on the dynamics of demand for each brand of tires, changes in the car market and weather and climatic conditions. And if earlier managers were engaged in such analysis manually on the basis of available information, experience and sometimes intuition, now they received a reliable, accurate and automatic tool for anticipating demand in the market.

Thus, our system has also become an expert on the Russian car market and climatic peculiarities of Russia.